Understand the portfolio dynamics of your policyholders at a household level

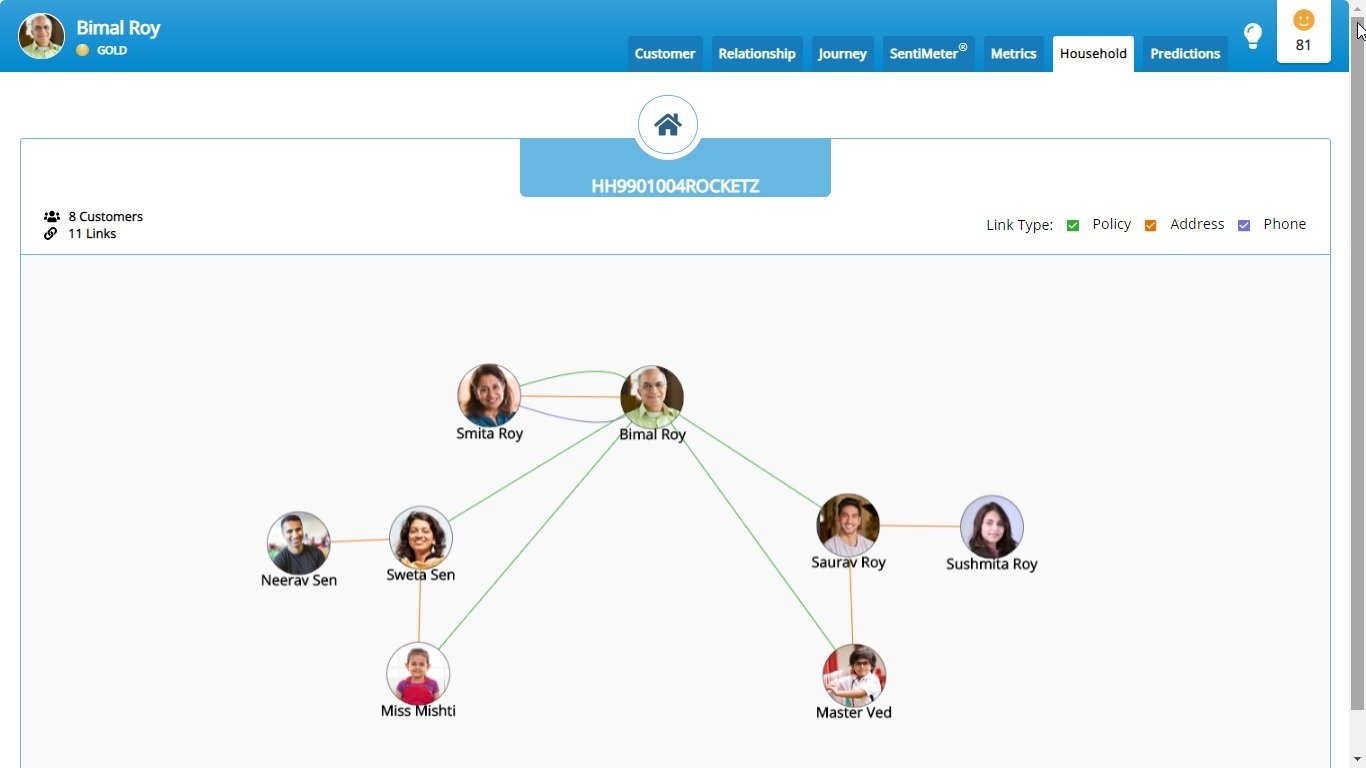

Household analytics provides insurance carriers and agents the ability to view and understand the portfolio dynamics at a household level instead of just at the individual level. Household analytics allows you to:

Offers for households can be different from the offers for individuals.

Once you have a clear view of a household, you can determine which offers are the best fit for each individual or family. Householding can also assist in identifying customers who may be at risk for non-renewal and provide the opportunity for early prevention.

HNI customers are your most valuable customers and, as a result, require extra focus and attention.

These affluent accounts need to be handled very diligently; a high-end customer account can continue to grow, and they require and expect exceptional services.

By having household analytics, you can remain in control and ask the appropriate questions to protect the client and their families. Stand out by customizing service offerings to meet the unique challenges and prevent any disruption to the household.

HNI clients are solid contributors to a life insurance portfolio and can be made more profitable by using specially designed strategies. These top-tier accounts may be contributing more than 30% of your overall active premium.

Household Analytics can help insurers reduce costs while maintaining profitable books of business.

Household Analytics can help insurers understand their customers better and therefore be able to provide the proper consultation and expert advice necessary for the entire household.

Household Analytics is essential to build brand loyalty, increase revenue and drive profits.

Find out how CRUX helped this insurer gain valuable insight into customer behavior based on unique groupings of customers.

Keep up to date on AI-based solutions and technology by following our blog.