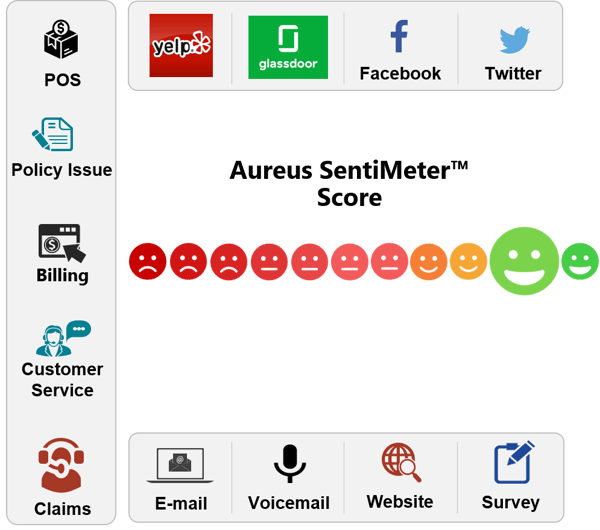

Do you want to know if your customer is happy or dissatisfied with your service? Customer sentiment is of utmost importance - it provides an overall understanding of how your customer feels. Sentiment analytics uses artificial intelligence (AI) to calculate a score based upon various events across the customer's journey.

The SentiMeter® score is generated by an advanced algorithm that factors customer interactions such as:

These customer interaction events are gathered from multiple sources that can be either structured or unstructured data.

Structured data is data that is stored in a spreadsheet or database.

Unstructured data is defined as data that has no predefined format. Claim diary notes and voice recordings are examples of unstructured data.

Hidden within both types of data lies the actual sentiment of an individual. SentiMeter® is able to take both structured and unstructured data such as voice recordings and social media posts and determine the sentiment of each individual policyholder.

Sentiment analysis comes from structured and unstructured data, but the two main categories are implicit and explicit feedback.

Once implicit and explicit data is gathered, CRUX uses a combination of natural language processing (NLP) and machine learning (ML), and deep text analytics to bring out the nuances hidden in the text.

Target unhappy customers - identify customers who are not happy and determine next steps

Identify account rounding and retention opportunities - determine cross-sell and upsell opportunities

Reach out to silent customers - silent doesn't always mean happy; they may be at risk for non-renewal

Identify product opportunities - improve market campaigns & strategies

Track sentiment over time - track customer sentiment history, understand trends

Segment customers - combine sentiment score with demographics

Many times agents can be blind-sided by issues that have been brewing with customers over a short or long period of time. When an issue is surfaced by the customer as opposed to being proactively addressed by an agent, everyone is now in catch-up mode that can be detrimental to the customer experience.

Listen to Jackie Vergne and Kurt Thoennessen from Ericson Insurance Advisors to learn how Sentiment Analytics can help your organization pro-actively identify issues so they can be resolved to improve the customer experience of your policyholders.